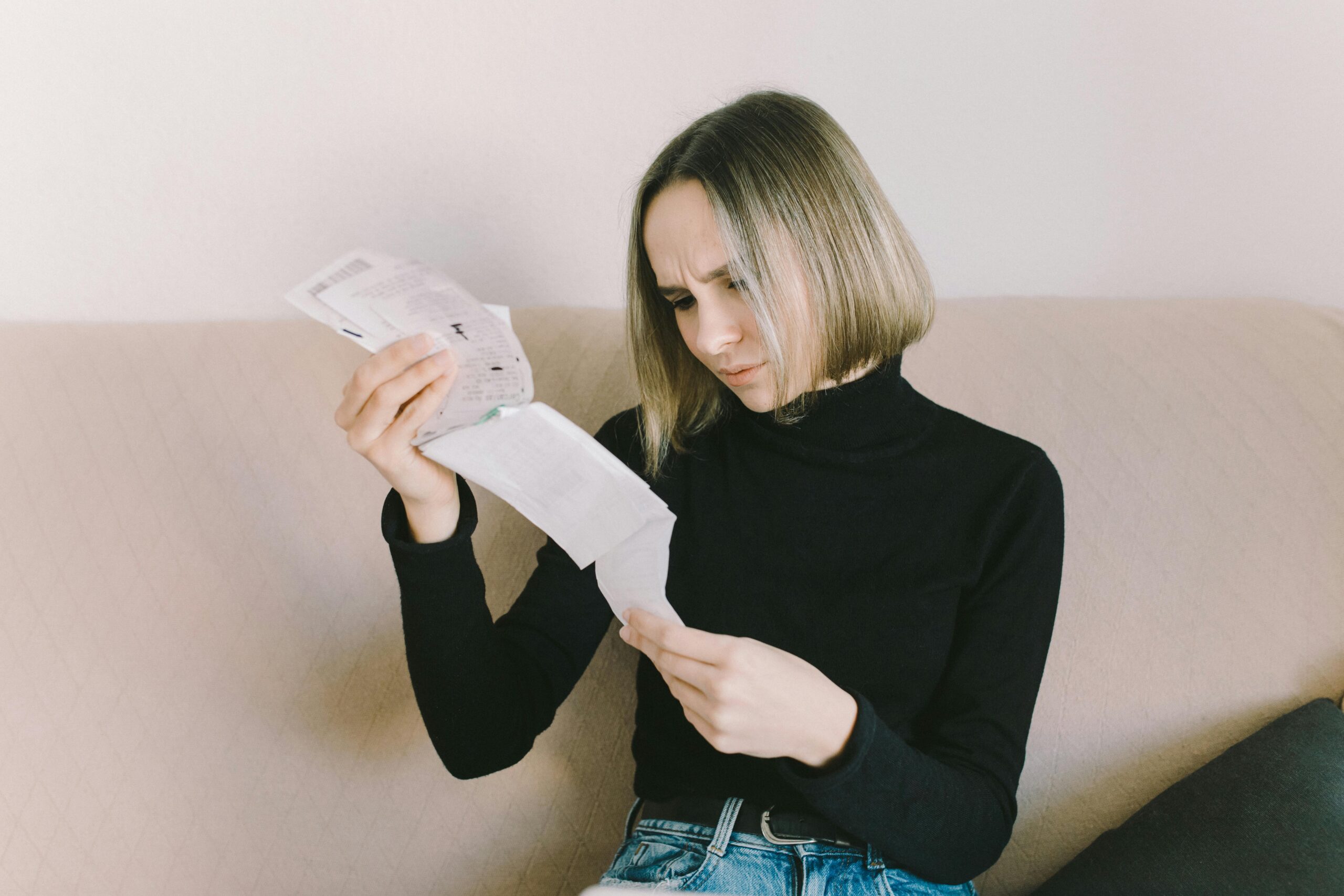

So, what’s the deal with these DWP cost of living payments everyone keeps buzzing about? Honestly, it feels like no one’s really breaking down how these payments might actually help your finances, right? I mean, sure, the government throws around phrases like “support” and “relief,” but how much of that really trickles down to your bank account? If you’ve been wondering how can DWP cost of living payments boost your finances, you’re definitely not alone — and maybe it’s just me, but this whole thing is way more interesting than it looks at first glance.

Now, you’d think this would be obvious, yet so many people still don’t get why these payments actually matter, or how to make the most of them. Are these just a little bonus, or a genuine lifeline when bills pile up? And why is no one talking about the long-term effects on your budget? These cost of living payments could be a game-changer, especially with prices skyrocketing everywhere — from groceries to energy bills. Not gonna lie, I was kinda surprised how much these payments can actually ease the pinch if you know what you’re doing.

So, if you’re scratching your head about what exactly the DWP cost of living payments are, or wondering whether they’re enough to make a difference, stick around. We’re about to unpack the nitty-gritty — the good, the not-so-good, and maybe some things you hadn’t considered before. Because, hey, understanding these payments might just be the secret weapon your finances need right now.

What Are DWP Cost of Living Payments and How Can They Significantly Improve Your Monthly Budget?

Alright, let’s dive into this whole thing about DWP Cost of Living Payments, yeah? You might’ve heard the term thrown around a bit — especially if you’re one of those folks juggling bills like a circus act. Basically, these payments are supposed to be a bit of a lifeline, a nudge from the government to help with the skyrocketing cost of, well, living. Sounds simple enough, but like most things involving the DWP, it’s a bit more tangled than that.

What Are DWP Cost of Living Payments Anyway?

So, “DWP” stands for Department for Work and Pensions — the lot responsible for dole, pensions, and other social benefits. The Cost of Living Payments (and yes, the name is a mouthful) are one-off or periodic cash boosts sent to eligible people. The idea is to help with the pinch caused by rising prices — energy bills, food, rent, you name it.

Not really sure why this matters, but these payments started popping up around 2022 when inflation went bonkers and people were freaking out about affording the basics. The government decided, “Right, let’s chuck some extra money at those on benefits to ease the pain.” Whether it’s actually enough to make a dent? Eh, that’s debatable.

Who’s Eligible for These Payments?

If you’re wondering if you qualify, here’s the gist — it’s mainly aimed at people already receiving certain benefits. Think:

- Universal Credit

- Pension Credit

- Income Support

- Employment and Support Allowance (ESA)

- Jobseeker’s Allowance (JSA)

And a few others thrown in for good measure. But it’s not like everyone on benefits gets it automatically — the DWP has their checklist and hoops to jump through. Sometimes you gotta wait for the payment to just magically appear, which is, honestly, a bit frustrating.

How Do These Payments Actually Work?

Right, so here’s where it gets a bit messy. The payments aren’t always consistent in amount or timing. For example, in 2022, there was a £650 payment for people on means-tested benefits — but then later on, other payments like £300 or £150 were introduced for different groups. Confusing? Absolutely.

Here’s a quick table to make it slightly less headache-inducing:

| Payment Amount | Who Gets It? | When? |

|---|---|---|

| £650 | Means-tested benefit recipients | Autumn 2022 |

| £300 | Pension Credit recipients | Autumn 2022 |

| £150 | Disability benefits recipients | Autumn 2022 |

| £324 (energy) | Some other eligible households | Early 2023 |

Bear in mind, these are rough and ready figures, and the government might announce new payments or change things up depending on how the economy is behaving. Seriously, who even came up with this? It’s like trying to catch smoke.

Dwp Cost Of Living Payments: How Can They Boost Your Finances?

Ok, so the obvious answer is: more cash = less stress paying bills. But it’s not just about throwing money at the problem. These payments can:

- Help cover energy bills, which have gone through the roof.

- Reduce the need to dip into savings or borrow money.

- Offer a little breathing room for essentials like food and transport.

- Potentially stop you from falling behind on rent or council tax.

But here’s the kicker — if you’re living paycheck to paycheck, even a few hundred quid can feel like a godsend. Maybe it’s just me, but sometimes it’s the small things — like being able to put the heating on without guilt — that make a massive difference.

Practical Tips to Make the Most of Your DWP Cost of Living Payment

Alright, so if you’ve got your hands on one of these payments (or you’re expecting it), here’s a cheeky little list to actually stretch it:

- Prioritise essential bills first — rent, energy, water.

- Avoid splurging on non-essentials (tempting, I know).

- Consider bulk-buying basics like tinned goods or loo roll — it adds up.

- Use it to clear small debts — saves on interest later.

- If possible, stash some away for a rainy day (easier said than done, obviously).

Quick Reality Check: It’s Not a Magic Fix

Look, I get it — these payments aren’t going to solve the cost of living crisis. They’re a bit like putting a plaster on a broken leg. They help, but the underlying problems (low wages, high inflation, energy price hikes) are still there. Plus, the whole process can be a right faff — paperwork, waiting times

Top 5 Ways DWP Cost of Living Payments Can Help You Cope with Rising Household Expenses

Alright, so here we are again, trying to make sense of the whole DWP cost of living payments thing. Honestly, with prices skyrocketing like there’s no tomorrow, who wouldn’t want a bit of extra cash to keep the lights on and the telly running? If you’ve been scratching your head wondering “DWP cost of living payments: how can they boost my finances?” — well, you’re in the right place, even if I’m kinda half awake writing this at 2am. Let’s dive into the top 5 ways these payments might just be the lifesaver you didn’t know you needed (or maybe you did, I mean, who isn’t desperate these days?).

Why Are DWP Cost of Living Payments Even A Thing?

Before I get carried away, a quick refresher. The Department for Work and Pensions (DWP) rolled out these cost of living payments as a response to the ever-annoying surge in household expenses. Think energy bills going through the roof, food prices that make you wince, and a general “where’s my money going?” feeling every month. These payments are basically a form of financial aid targeted at people on certain benefits to help ease the blow. Not charity, mind you — more like a nudge so folks don’t end up in the soup.

Anyway, what was I saying again? Right, how these payments can help you cope. Let’s get into it.

Top 5 Ways DWP Cost of Living Payments Can Help You Cope with Rising Household Expenses

Reducing the Pressure of Energy Bills

Honestly, energy bills are the biggest culprit here. The government’s been throwing these payments at people partly to help with that. Even a small lump sum can make a difference when you’re deciding between heating and eating (don’t pretend you haven’t been there). It’s not a total fix, but hey, it’s a start.Offsetting Food Costs

Food prices have been doing a slow climb, like that annoying relative who never stops talking. The DWP payments can help you stock up on essentials or maybe splurge on a cheeky takeaway now and then — because, seriously, who has the time to cook every night? These payments are designed to put a little more grub on your table without you having to tighten your belt too much.Helping with Unexpected Expenses

Life’s full of surprises (mostly bad ones, right?). The DWP’s cost of living payments aren’t just for bills — they can help cushion any sudden expenses like car repairs or school costs. It’s not a fortune, but it’s like finding a tenner in your old coat pocket when you least expect it.Easing Debt Repayments

If you’re juggling debts, these payments might give you a bit of breathing room. It’s tempting to just shove the money towards your overdraft or credit card, and honestly, that’s probably a smart move. Less interest, less stress. But, I’m not your financial advisor, so do what feels right.Supporting Mental Wellbeing

This one’s a bit less obvious but equally important. Constant financial strain can mess with your head — anxiety, stress, the lot. Knowing there’s a bit of extra cash coming in can actually lift your mood. Not that money buys happiness, but when you’re not panicking about the bills, it’s a start.

Dwp Cost Of Living Payments: How Can They Boost Your Finances?

It’s tempting to think these payments are just a drop in the ocean, and yeah, they kinda are. But when you add them up over time or combine them with other benefits, it’s like getting a leg up when you’re stuck in a hole. Especially if you’re on a fixed income, every penny counts.

Here’s a rough table to give you an idea of what you might expect (bear in mind, this stuff changes, and I’m no DWP spokesperson):

| Payment Type | Typical Amount (£) | Who Qualifies | Frequency |

|---|---|---|---|

| Energy Cost Payment | £400 – £600 | Households on means-tested benefits | One-off or split |

| Disability Energy Payment | £150 – £300 | Disabled people on certain benefits | One-off |

| Pensioner Cost of Living | £300 – £500 | Pensioners on Pension Credit | One-off or split |

| Universal Credit Boost | Varies | Universal Credit claimants | Monthly/One-off |

| Council Tax Support | Varies | Low-income households | Monthly |

Not exhaustive, but gives you a flavour.

Sorry, had to grab a coffee — anyway…

If you’re eligible, make sure you’re signed up

Who Qualifies for DWP Cost of Living Payments? A Step-by-Step Guide to Boosting Your Finances

Alright, so you’re probably wondering, “Who qualifies for DWP Cost of Living Payments?” and if these things even help with your finances or if it’s just another bureaucratic headache. Honestly, I get it. The whole DWP cost of living payments thing sounds like some government mumbo jumbo that only exists to confuse us all. But, if you’re strapped for cash (and who isn’t these days?), these payments could be a tiny lifeline. So, let’s try to unpack this mess without falling asleep or getting lost in official jargon.

What Are DWP Cost of Living Payments Anyway?

First off, for those not in the know—the Department for Work and Pensions (DWP) has rolled out these cost of living payments to help folks deal with, well, the rising cost of living (duh). They’re meant to support people who rely on certain benefits because, let’s face it, inflation’s been doing a number on everyone’s wallets. The payments are like a bit of extra cash to help with bills, groceries, or, you know, that fancy coffee habit you keep pretending you don’t have.

Who Actually Qualifies for These Payments?

Now, this is the crucial bit. Not everyone gets a slice of this pie, and it’s not always crystal clear who is in or out. Here’s a quick rundown of the main groups who might qualify:

- Recipients of means-tested benefits: Think Universal Credit, Income Support, Income-based Jobseeker’s Allowance, Employment and Support Allowance (ESA) – basically, if your benefits depend on your income and savings, you might be in.

- Pension Credit recipients: If you’re on Pension Credit, you’re likely eligible.

- Disability benefits claimants: Those getting Personal Independence Payment (PIP), Disability Living Allowance (DLA), or Attendance Allowance could also qualify.

- Carers: People receiving Carer’s Allowance sometimes get these payments too.

But—and here’s the kicker—the exact eligibility can depend on when you got your benefits, what type, and a few other bits and bobs. Seriously, who even comes up with these rules? It’s like they’re designed to make your head spin.

Step-by-Step Guide: How To Check If You Qualify (Without Losing Your Mind)

Right, if you want to figure this out properly, here’s a rough guide. I swear I’m not a government official, but this might help:

- Check your current benefits: List out every benefit you’re getting. Might sound obvious, but sometimes you forget what you’re on.

- Visit the official gov.uk page: They usually have a tool or a list that tells you if you’re eligible for cost of living payments.

- Look for the payment schedule: These payments come in instalments, not all at once. Knowing when to expect them prevents those “where’s my money?” freakouts.

- Contact DWP directly: If you’re still confused, call or even visit your local Jobcentre (ugh, I know) and ask for clarification.

- Keep an eye on your bank account: If you qualify, the money should just land there – no need to apply separately usually.

DWP Cost of Living Payments: How Can They Boost Your Finances?

Okay, so you’re probably thinking, “Cool, I might get this money, but how much of a difference will it make?” Honestly, it’s not going to turn you into a millionaire overnight, but every little helps, right?

The payments vary depending on your circumstances but usually fall somewhere between £300 to £650 per year, given in chunks. It’s not enough to cover rent or mortgage, but maybe it pushes you over the edge when it comes to heating your flat or buying food. When energy bills are through the roof, even a couple hundred quid can feel like a win.

Here’s a quick look at how these payments might stack up for different folks:

| Benefit Type | Approximate Payment Amount | Frequency |

|---|---|---|

| Universal Credit recipients | £326 – £650 | In several instalments |

| Pension Credit claimants | £326 – £650 | Split payments |

| Disability benefits claimants | £326 – £650 | Multiple times |

| Carer’s Allowance recipients | £326 – £650 | Instalments |

Honestly, I wish it was more straightforward. Sometimes you get one payment, sometimes three, and sometimes none. It’s like the government’s version of a mystery box.

Why This Still Matters (Even If It’s a Bit of a Faff)

Look, the cost of living crisis isn’t going anywhere soon, and for many, these payments are more than just pocket change—they can mean the difference between skipping meals or not. It’s

How to Maximise Your Benefits: Expert Tips on Using DWP Cost of Living Payments Effectively

So, the government’s been handing out these DWP Cost of Living Payments lately, right? And honestly, if you’re like me – perpetually broke and wondering how to stretch a tenner till next Tuesday – you probably wanna know: how to actually make these payments work for you. Because, let’s face it, they’re not exactly a fortune, but every penny counts. Or so they say. Anyway, if you’re scratching your head wondering DWP cost of living payments: how can they boost your finances? then this might just be the rambling guide you didn’t know you needed. Spoiler: it’s not rocket science, but it’s not all sunshine either.

What Are DWP Cost of Living Payments, Anyway?

Right, before we dive in, a quick refresher. The DWP (Department for Work and Pensions, for the uninitiated) rolled out these payments to help folks cope with the ever-climbing prices for stuff like energy bills, food, and basically existing in this mad world. They’re one-off or sometimes staggered payments to those receiving certain benefits or on low incomes. Think of it as a tiny lifeline tossed your way when things are a bit grim money-wise.

Historically, these payments popped up in response to the sharp inflation spikes post-pandemic and the Ukraine crisis (seriously, who even came up with this?). The government’s been trying to patch up this cost of living crisis, but honestly, it feels like putting a plaster on a broken leg sometimes.

How Can These Payments Actually Help Your Wallet?

Okay, so getting a few hundred quid all at once is nice and dandy, but how do you maximise the benefit? Because, let’s be honest, blowing it all on a takeaway and a few cans of lager is tempting but not super helpful in the long run.

Here’s where some expert tips might come in handy – or at least that’s the idea.

- Prioritise Essential Bills: Use the payment to cover urgent things like your energy bills or rent arrears. This prevents nasty late fees or disconnections later on.

- Top Up Your Food Shop: It’s tempting to splash out on treats, but sticking to essentials means you stretch your pound further.

- Avoid Debt Traps: Don’t use the payment to pay off payday loans or credit cards unless it’s absolutely necessary. Sometimes paying the minimum while saving a bit for emergencies is smarter.

- Plan for the Long Haul: If you can, try to split the payment – use part now, save part for a rainy day (because let’s be real, more storms are coming).

- Look for Discounts and Deals: Use the money in conjunction with local schemes or vouchers. Some councils offer extra help if you’re on benefits (not that it’s widely advertised, mind you).

Honestly, it’s like trying to juggle flaming torches while blindfolded, but a bit of planning can help.

Sorry, had to grab a coffee — anyway…

Where was I? Oh yeah, how confusing all this is. Because while these payments sound great on paper, the reality is a bit more complicated. For one, not everyone gets the same amount, and some folks don’t get anything at all. And then there’s the whole rigmarole of claiming, eligibility, and waiting times – which, if you ask me, feels like a bureaucratic nightmare designed to make you give up.

Quick Table: Who’s Eligible and How Much?

| Benefit Type | Payment Amount (£) | When Paid |

|---|---|---|

| Universal Credit | 650 | One lump sum in 2023 |

| Pension Credit | 300 | Paid automatically |

| Disability Benefits (e.g. PIP) | 150 | One-off payment |

| Other Means-Tested Benefits | 300 | Usually in instalments |

(These figures are subject to change, so don’t quote me on it forever.)

Making Your Payment Last Longer Than a Week

If you’ve ever been on benefits or just tight on cash, you’ll know the pain of a payment disappearing faster than your motivation on a Monday morning. Here’s a cheeky list to stretch that DWP payment:

- Budget like a pro (or at least try): Write down all your expenses. Shocking, I know.

- Avoid impulse buys: Easier said than done when you’re sleep-deprived and hungry.

- Use cashback apps or loyalty cards: Small savings add up over time.

- Swap energy suppliers if you can: Cheaper deals could save you more than the payment itself.

- Tap into community resources: Food banks, charitable grants, local discounts – they exist for a reason.

Wait… Isn’t This Just a Band-A

The Impact of DWP Cost of Living Payments on Low-Income Families: Real-Life Success Stories

So, here we are again, talking about money stuff that’s supposed to help people but somehow still feels like it’s not quite enough? Yeah, I’m referring to the DWP cost of living payments — those little lifelines thrown at low-income families who are just about keeping their heads above water in this mad economic mess. Honestly, the whole thing sounds like a bureaucratic headache, but turns out, for some folks, it’s been a genuine game changer. Weird, right?

The Impact of DWP Cost of Living Payments on Low-Income Families: Real-Life Success Stories

Right, before I get all cynical, let’s look at what these payments are actually doing. The Department for Work and Pensions (DWP) rolled out these cost of living payments to help people struggling with skyrocketing bills — energy, food, rent, you name it. The idea? To give a bit of breathing room in wallets that are already pretty threadbare.

Now, I know what you’re thinking: “Is this just a token gesture or does it really help?” Turns out, it’s a mixed bag, but there are definitely some success stories worth shouting about. Like, take Claire from Manchester — single mum, two kids, working part-time. She said the payments helped cover her electricity bill during the winter freeze. Without it, she’d have had to choose between heating and food (which is a grim choice no one should face, but sadly, many do).

Or there’s Ahmed in Birmingham, who used the funds to pay off some debts, which stopped those nasty phone calls from debt collectors. This gave him the mental space to focus on finding better work, rather than just surviving day-to-day.

Dwp Cost Of Living Payments: How Can They Boost Your Finances?

Okay, so you might wonder, “How exactly do these payments work? And can they actually boost my finances, or is it just smoke and mirrors?” Here’s the lowdown, in a nutshell:

- Who’s eligible? Mostly folks already on certain benefits like Universal Credit, Pension Credit, or Employment and Support Allowance. It’s not for everyone, which feels a bit unfair sometimes.

- How much do you get? It’s usually a lump sum, sometimes around £650 or so, but this can change depending on your situation.

- When do you get it? Payments are typically made in instalments, spread out over a few months — so it’s not like a massive windfall but more like a slow drip-feed.

- What can it cover? Energy bills, rent arrears, groceries, or even transport costs — basically anything that’s making your life harder financially.

Here’s a simple table to break it down (because who doesn’t love a table?):

| Benefit Type | Estimated Payment Amount | Payment Frequency | Typical Use Cases |

|---|---|---|---|

| Universal Credit | £650 (approx.) | Split in 2 instalments | Energy bills, groceries |

| Pension Credit | £324 (approx.) | One-off payment | Heating costs, prescriptions |

| Employment and Support Allowance | £650 (approx.) | Split in 2 instalments | Rent arrears, transport |

Honestly, if you’re on the fence about applying, just do it. It’s not the government throwing gold coins at you, but every penny helps when you’re juggling bills.

Why This Still Matters (Even If It Feels Like a Drop in the Ocean)

Look, I get it — this whole thing sounds like a paltry sum compared to the rising cost of living. I mean, who even came up with these amounts? Like, £650 might sound decent until you see your energy bill jump by twice that in a month. Seriously!

But here’s the thing: it’s not just about the cash injection. It’s about what that payment represents. A bit of relief. A chance to breathe. To not have to skip meals or choose between heating and keeping the lights on. For a lot of families, it’s the difference between sinking and swimming, even if it’s just for a short while.

Plus, on the broader scale, these payments also reduce the strain on other services — food banks, charities, mental health support — which get overwhelmed when people hit crisis points. So, yeah, it’s a small cog in a big machine, but an important one.

Hang on… Sorry, had to grab a coffee — anyway…

Back to the stories, because those are the bits that really hit home. Like Janice from Leeds, who told me she used the payment to fix her washing machine (a basic necessity, right?). It might sound trivial, but when you’re low-income, a broken washing machine can mean extra costs, trips to laundrettes, and just a massive headache

Conclusion

In summary, the DWP Cost of Living Payments are a vital support mechanism designed to help individuals and families navigate the increasing financial pressures caused by rising living costs. These payments aim to provide timely assistance to those most in need, including pensioners, low-income households, and people receiving certain benefits. Understanding eligibility criteria and application processes is crucial to ensure you don’t miss out on this valuable support. As the cost of living continues to pose challenges across the UK, staying informed about available government aid can make a significant difference to your household budget. If you believe you may qualify for these payments, it is advisable to check the latest guidance on the official DWP website or seek advice from local support organisations. Taking proactive steps now could ease financial strain and contribute to greater peace of mind during these uncertain times.